On the macro, all your crypto coins are doing the same thing but there’s a couple of differentiating factors. These could be:

Scale of pumps.

Minor differences in patterns.

Timing.

Sentiment.

In this post, we’ll focus on sentiment/timing.

As you probably know, coins like MANA, SAND, STARL, UFO, YGG have one thing in common. They are all metaverse coins that began going up earlier than other coins. The hypothesis is, it was because of the Meta branding of Facebook. You may be confused, as I said in the previous article that I don’t pay attention to news. But in situations like the recent metaverse trend, followed by metaverse coins going up, can confuse people. This is because, sometimes news can shift sentiment and determine timing, if technicals are already aligned. So in this case, it’s about reading the sentiment - not taking financial advice from news articles that appeal to masses. I’ll use the metaverse trend as an example to explain how sentiment may sometimes affect timing - only when technicals are also aligned. I don’t have a clear conviction on this topic. I will probably gain it by the end of this cycle and update accordingly.

When I detected such a trend, I posted a list of metaverse coins as you can see in the link below.

The top five coins on the tweet above is: MANA, SAND, STARL, UFO, YGG.

Let’s have a look at what happened to the first 5 of the metaverse coins listed on my tweet:

As you see, most of them did pretty well after the news and my tweet about it. There’s also the case of the dog coins trend after Elon Musk tweeted about doge. Those coins exploded and people made tons of money.

Incase it isn’t clear, sentiment reading is about reading the news, then thinking what the people who read the news is going to think and taking action accordingly. This is because the news influences people. You’re not taking financial advice from the news, you’re just trying to estimate the effect it may have on people, who are less informed than you. So let’s say you read “vaccine is bad”, you can bet on the increase of anti vaxxers, who take medical advice from the news, if the platform that posted it, is mainstream enough. It’s just a case of news influencing people, then as a result, controlling the narrative.

Now let’s get to the point. Is this a proof that timing can be correlated to sentiment? Can we estimate, through reading the sentiment, which coins are going to move when? As you already know, we have trends in crypto that make some coins move before others. This just means some coins reach their targets before the rest of the market. If you see a sentiment shift towards something, you can bet those coins may move and reach their targets before other coins. But by the time majority of people realise this trend, it’s either too late or you just don’t know how long it will last so you just keep watching it go up and never participate. Another scenario is where people think they are too late and don’t ever touch the trending coins. Then they give in and go all in. The emotion you experience that made you “give in” is usually something experienced near a local top. FOMO. The minute you buy, trending coins turn into a long sideways price action or dump. This is why, for majority, by the time you become aware of a trend and actually begin buying, it’s usually too late or it will end up with them becoming a bag holder.

Now look back at the charts I posted. Let’s use MANA and SAND as examples. If you check back their charts, they started doing a trend reversal after the news was announced. The only thing the Meta to Facebook rebrand did was, it changed the timing of when those coins started moving. It didn’t change the targets and it didn’t change the potential path they would follow.

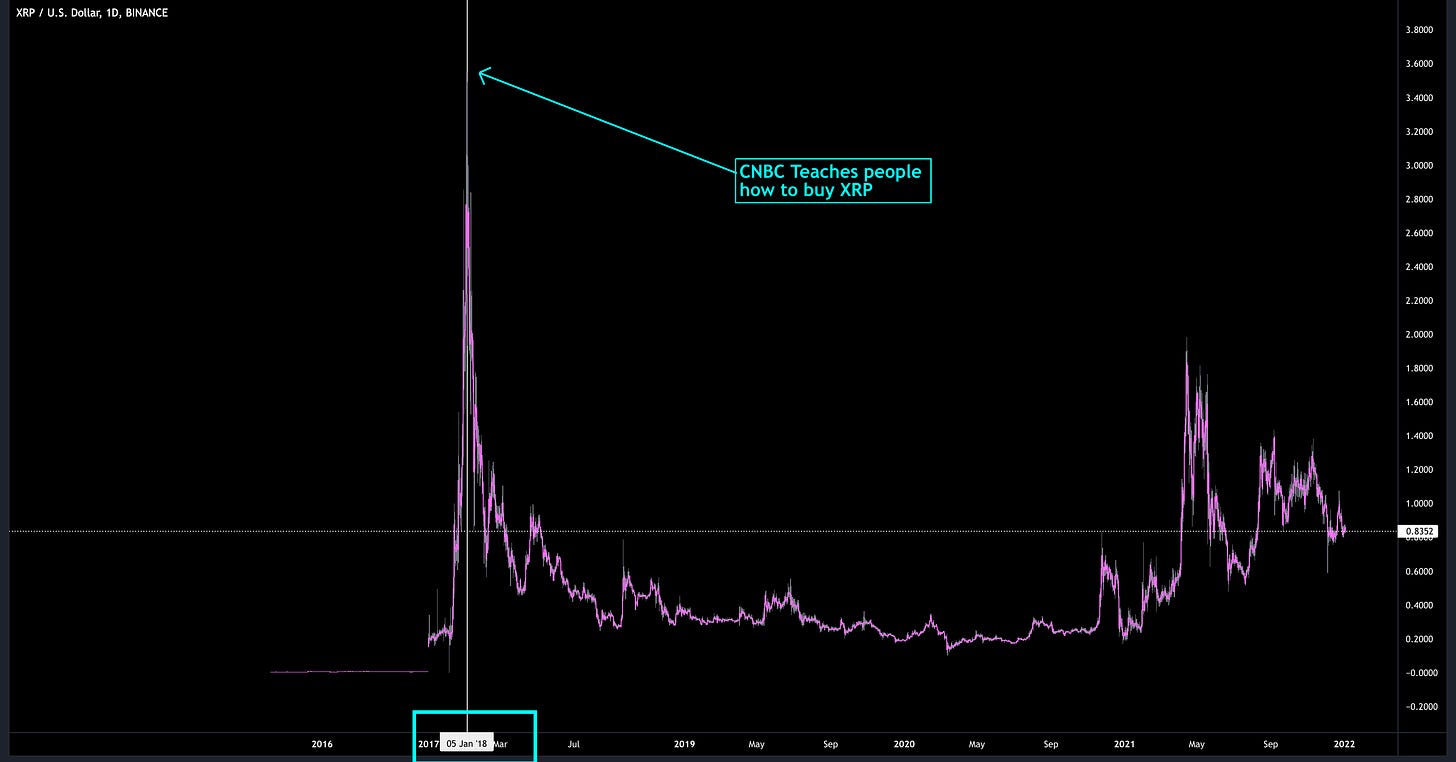

On the other hand, there’s been other attempts to read the sentiment with no luck in the past as well. So technicals have to be aligned with the fundamentals. As mentioned in the previous post, “trigger fundamentally, enter and exit technically”. So basing your whole analysis on sentiment reading alone won’t be strong. In 2018, CNBC taught people how to buy XRP at the top. Using this “sentiment reading” logic, one would argue that this is going to make people buy XRP but if you know what happened, as shown in the chart below, it was the literal top. They were looking for exit liquidity. So you need to be able to read the intention, as well as the sentiment, with technicals aligned. There’s also another dimension to the CNBC example though. You should counter-trade the masses, especially when they get too euphoric and are financially illiterate. So I’m not exactly sure how to explain a way to differentiate between the two sentiments but what we can get out of this example is: never take financial advice from the news, especially if it appeals to masses that are financially illiterate.

I’m still learning but these are some interesting things to think about, that I still think about. I will probably form a much better conviction about this at the end of this cycle and update with my findings. I have targets on majority of Binance coins and if they follow my analysis, no matter what the sentiment, then it will mean trends or sentiment do not mean anything and I can completely ignore them in the future with good conviction. Currently, I ignore trends completely as my rule is to avoid them. This is because, trends can be distracting and tend to be more emotion-based trades where you jump from coin to coin, losing perspective of the market as a whole and end up underperforming majority of coins if you had just held onto one coin.

Let me know what you think. I opened my Twitter DMs to everyone.